Demystifying disability insurance

If you’re like most people, you probably haven’t given much thought to getting disability insurance. You may not even know what it covers or who it’s right for. But Open Enrollment is the perfect time to check out if enrolling in a disability plan is the right choice for you.

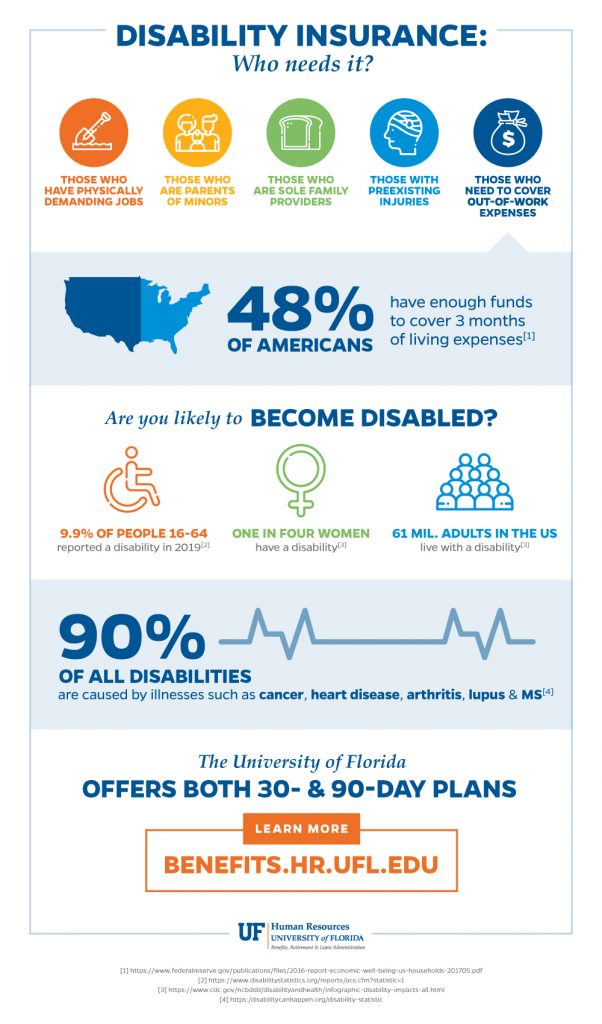

Disability insurance is an effective way to protect a portion of your income in the event you become injured or ill. In fact, 90 percent of all disabilities are caused by illnesses such as cancer, heart disease, arthritis, lupus and multiple sclerosis (MS).

What is disability insurance and who needs it?

What is disability insurance and who needs it?

We understand, for many, the last thing you’re thinking about is an injury or illness that could sideline you, keeping you from your paycheck. But life happens to the best of us, and knowing how long you could go without working or earning a biweekly check may encourage you to think about disability insurance, which can help cover your living expenses in the event of a short- or long-term disability like an injury, accident or illness.

For some, disability insurance makes good sense. People who have physically demanding jobs, parents who are responsible for minor children and sole providers for a family might benefit from having a disability policy in place. You also likely will benefit if you know you don’t have the needed funds to cover a short — or long — period of being out of work.

A report on economic well-being from The Federal Reserve found only 48% of Americans have enough funds to cover three months of living expenses.

Are you likely to become disabled?

- 10% of men and women ages 16-64 in Florida reported a disability in 2019

- 61 million adults in the U.S. live with a disability according to the Centers for Disease Control

- 1 in 4 women have a disability [1]

- The percentage of people with disabilities is highest in the south [2]

How does disability insurance work?

Disability insurance is designed to pay a portion of your paycheck if you can’t work due to a qualifying illness or injury.

UF offers both 30- and 90-day plans. The 30-day plan begins paying benefits after 30 days of a covered illness or injury, while the 90-day plan starts paying after 90 days. The benefit amount is based on your income. Among UF’s plans, the 90-day plan is most often selected.

The State of Florida also offers plans that, while a bit more costly, allow you to elect a lower elimination period. Learn more about them on their website.

It’s important to note that anyone who enrolls in a disability plan through Open Enrollment will need to pass medical underwriting. Pre-existing conditions may be covered by a disability policy after a period of time, so you may want to review these provisions directly with the carrier if applicable. Pregnancy is also usually viewed as a pre-existing condition, which could be an important factor if you are expecting and exploring coverage. Links to both State and UF plans (including a plan brochure and maternity FAQs) are available on the UFHR Benefits website.

Open Enrollment is a great time to explore the disability policies offered by UF and the State of Florida. Having this coverage in place could mean you are able to meet expenses and care for your family if an injury or illness keeps you from working, and that spells peace of mind.

Please contact UFHR Benefits at benefits.hr.ufl.edu/contact/ for assistance.

[1] https://www.cdc.gov/ncbddd/disabilityandhealth/infographic-disability-impacts-all.html

[2] https://www.cdc.gov/ncbddd/disabilityandhealth/infographic-disability-impacts-all.html